The age limit was previously restricted to those over 65. Downsizer contributions from age 60įrom 1 July 2022 downsizer contributions to eligible superfunds for contributors over the age of 60 will be permitted. In accordance with the previously legislated schedule of super guarantee increases, the rate moves from 10% to 10.5% from 1 July 2022. See further info and links at Digital Games Tax Offset. The tax offset is intended to provide an incentive for firms to attract digital talent to Australia. Digital Games Tax OffsetĪs part of the Budget 2021 and subsequent MYEFO the government announced a 30% per cent refundable tax offset to apply from 1 July 2022 for eligible businesses that spend a minimum of $500,000 on qualifying Australian games expenditure.

* Calculations are based on currently legislated tax rates applying to a future period and could change before then in accordance with changes in government policy. Employer reporting obligations are adjusted to reflect the change. Employee Share Schemesįrom 1 July 2022 cessation of employment is removed as a taxing point for deferred tax schemes. Subsequent proposals increased the value of the new offset to $700, and it was brought forward to apply for the 2021 and increased by $420 for the 2022 year. Under Budget 2018 proposals a new low income offset, initially up to $645, was introduced to replace both LITO and LMITO. A Medicare Levy Surcharge may also be applicable and is applied on a progressive basis if eligible private health insurance cover is not maintained.Įntitlement to the low and middle income tax offset

#CURRENT TAX BRACKETS FULL#

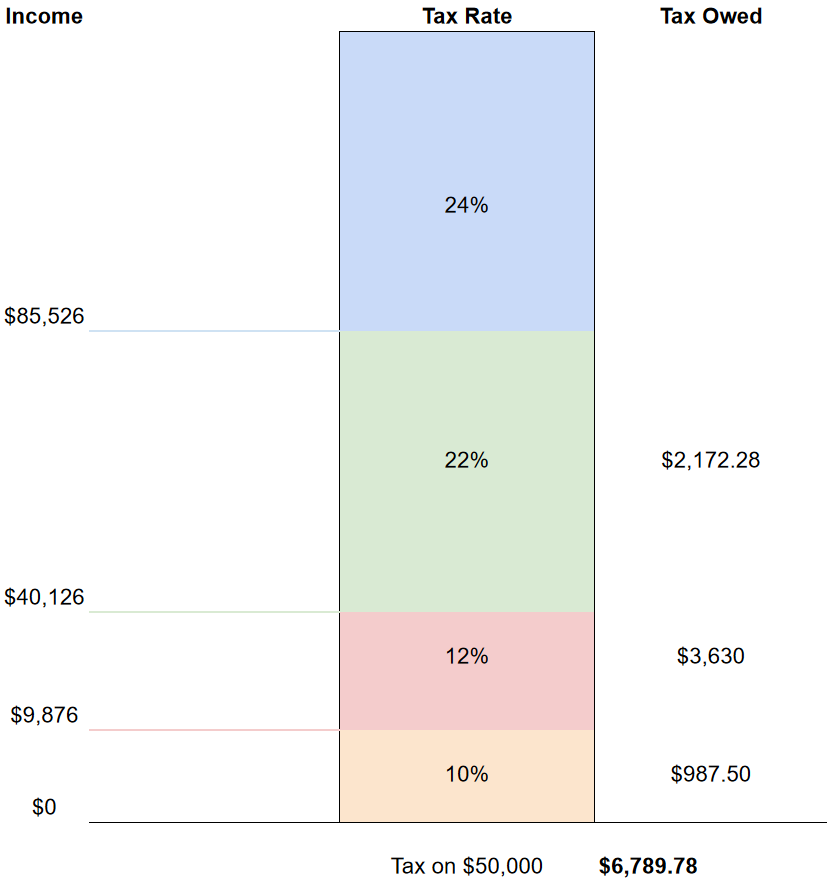

There are low income and other full or partial Medicare exemptions available. The above tables do not include Medicare Levy or the effect of any Low Income tax offset (“LITO”). The Federal Budget on 29 March 2022 did not result in any changes to tax rates or income thresholds for the 2022-23 income year. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024, which include an expansion of the 19% rate initially to $41,000, and lifting the 32.5% band ceiling to $120,000.Ī subsequent Budget 2019 measure further expanded the 19% income ceiling to $45,000 from 1 July 2022. The 2018 Budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 July 2018 through to 1 July 2024. However, watch for updates before the end of the year, especially in the May 2023 Budget. The basic tax scales are the same as the previous year, but the Low & Middle Income Tax Offset drops out which would effectively increase tax for lower income earners. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year. The 2023 financial year in Australia starts on 1 July 2022 and ends on 30 June 2023.

0 kommentar(er)

0 kommentar(er)